top of page

OVERVIEW

Gulf Bank - Kuwait set out to modernise branch operations by embracing automation and counter-less engagement, aiming to create SMART branches that significantly enhance customer experience. This initiative focused on transforming traditional banking into a seamless, tech-driven experience that aligns with the needs of today's digital-savvy customers.

CLIENT

PROBLEM STATEMENT

The challenge was to design an intuitive interface for self-service kiosks and teller counters, aiming to reduce long wait times while digitising 60 years of manual banking processes. This transformation required a seamless user experience to modernise and streamline branch operations.

ABOUT THE CLIENT

Gulf Bank- Kuwait is one of the largest leading banks in Kuwait with a broad offering of consumer banking, wholesale banking, treasury, and financial services.

-

Founded in 1960

-

Assets: KWD 6 billion (1 KWD = 256 INR)

-

Network:

-

Branch: 58

-

ATM’s: 250+

AGILE FRAMEWORK

Agile is a flexible project management approach that focuses on collaboration and adaptability. It breaks work into short cycles called sprints.

Scrum is a specific framework within Agile that helps teams organise their work. It involves dividing tasks into sprints, holding daily meetings, and conducting reviews for continuous improvement.

THE PROCESS

User Stories

Module Brief

Process Flows

Design

Reviews

Design

Reviews

NEED & BENEFITS OF SELF-SERVICE KIOSK

An automated self service kiosk aims to fulfil few dire requirements for the working class in Kuwait. A concise wait to put it would be as the following:

-

It is convenient

-

It works 24/7

-

It promotes less paperwork

-

It reduces wait time in long ques significantly

CUSTOMER JOURNEY FOR SELF-SERVICE KIOSK (HAPPY FLOW)

Fig 1: Representation of the of an ideal customer flow at a self-service kiosk

CONCEPTS

We explored multiple visual design concepts, experimenting with various styles to align with the client's requirements and preferences. This approach provided them with a range of options to choose from, allowing them to select the direction that best suited the desired look and feel of the system.

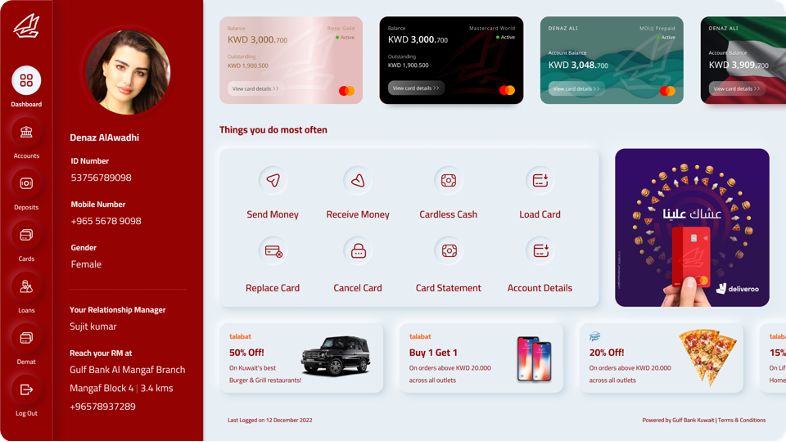

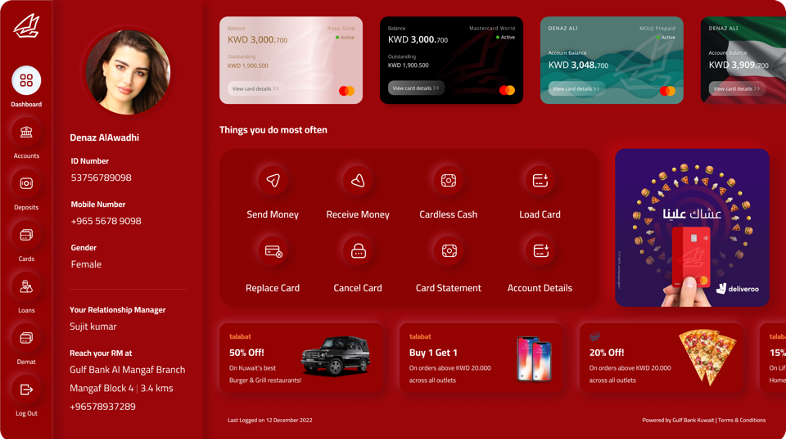

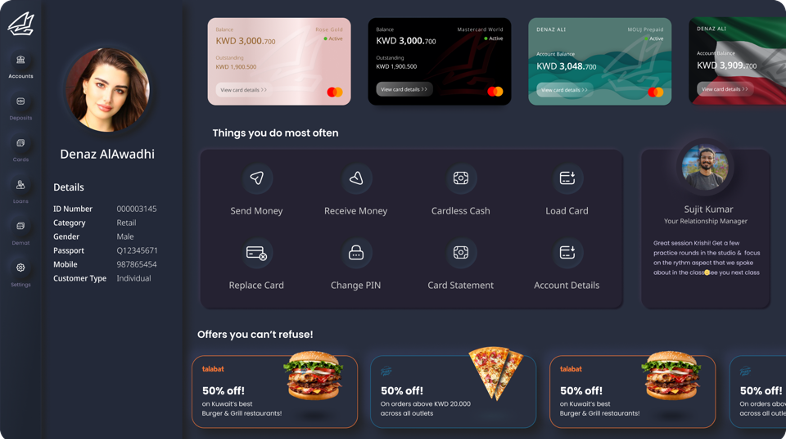

Fig 2: Concept explorations for visual design of self-service kiosk

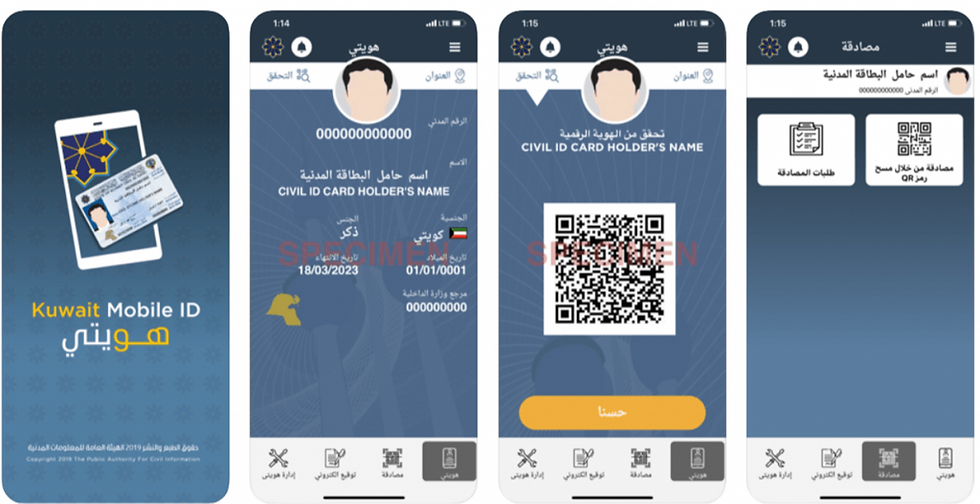

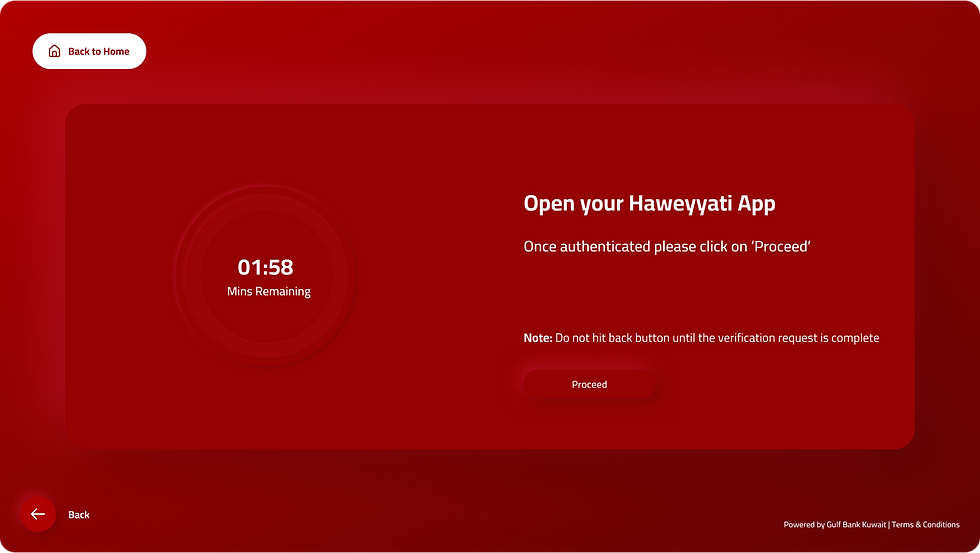

KUWAITI GOVERNMENT’S HAWEYYATI APP

The Haweyyati App is a digital identity platform launched by Kuwait to streamline access to government services. It enables citizens and residents to securely authenticate their identities, access e-government services, and manage official documents through a single, user-friendly interface. The app is part of Kuwait’s broader initiative to digitize public services, enhancing convenience and efficiency for users while ensuring robust security measures.

The Haweyyati App can be used in SMART Bank branches for quick and secure identity verification, streamlining the customer authentication process and enhancing the efficiency of banking services.

Fig 3: Kuwaiti Government’s Haweyyati App used for customer verification

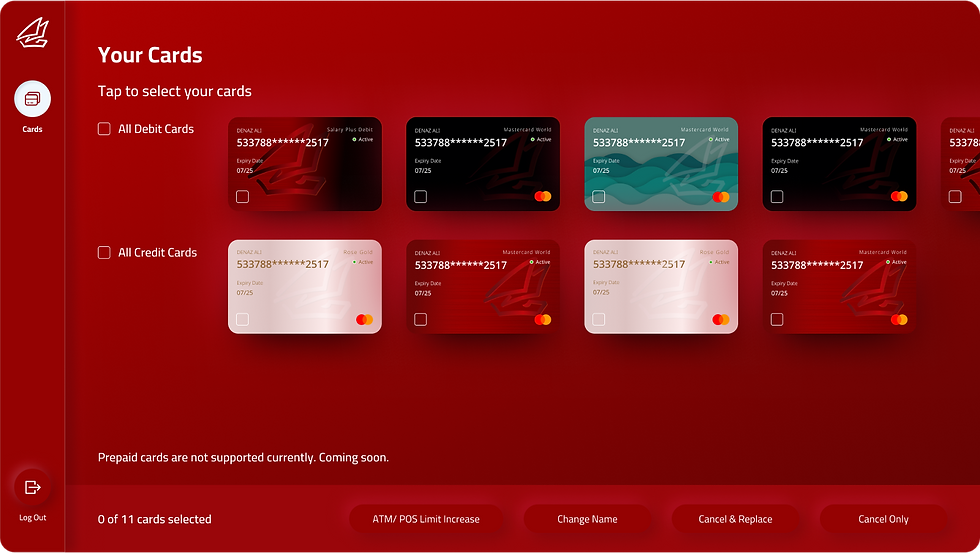

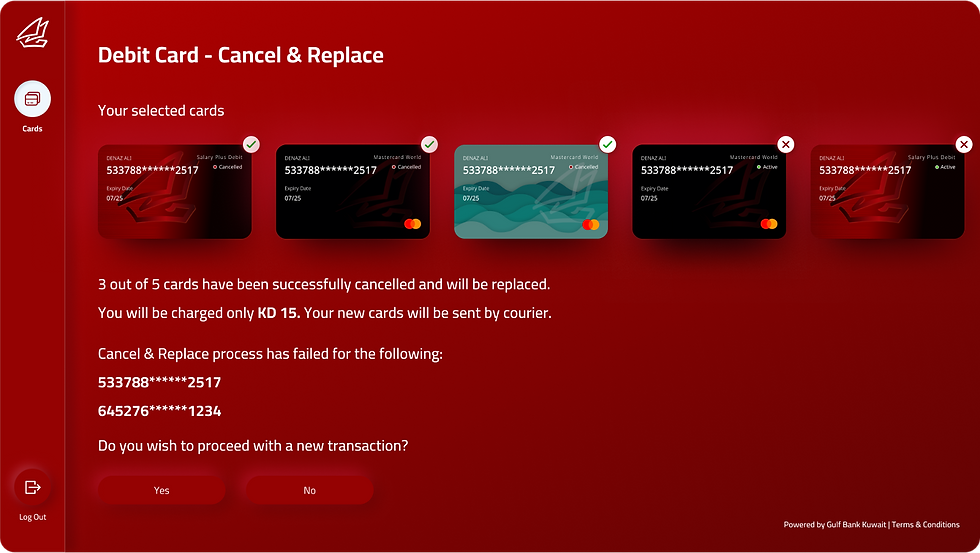

DESIGN AND TASK FLOWS FOR SELF SERVICE KIOSK

In this Visual Design project, we were tasked with creating screens for various workflows to support the functionalities of an Automated Bank Branch. We designed screens for multiple use cases, focusing on the features scheduled for release in Phase 1. Some of these include:

CUSTOMER JOURNEY FOR SELF-SERVICE KIOSK (ALTERNATE FLOW)

Fig 4: Representation of the of an alternate customer flow at a self-service kiosk

BANK TELLER TASKS

In addition to designing the 'Happy Path' for the self-service kiosk, we identified alternative customer journeys that may arise. In these scenarios, the Bank Teller plays a crucial role, performing specific tasks to assist the customer and ensure a seamless workflow.

Fig 5: Segregation of tasks expected to be performed by the bank teller

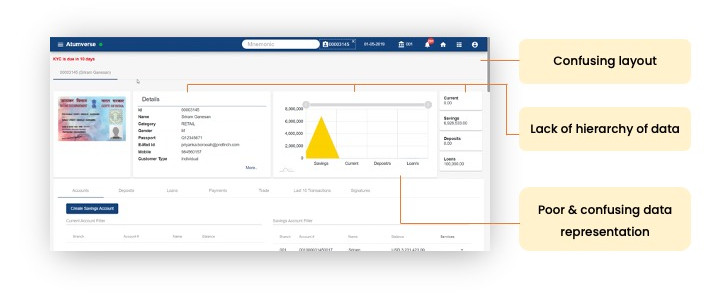

EXISTING SYSTEM SCREENS FOR A BANK TELLER

Fig 6: Existing Bank Teller Screens provided by the client

BLUE PRINT OF THE BANK TASK FLOWS

The client supplied detailed task flow blueprints through the Jira Confluence platform. We leveraged these blueprints to gain a deep understanding of each process, enabling us to design precise screens tailored to the specific requirements of each task.

Fig 7: An example of the blue print of a task flow as provided by the client

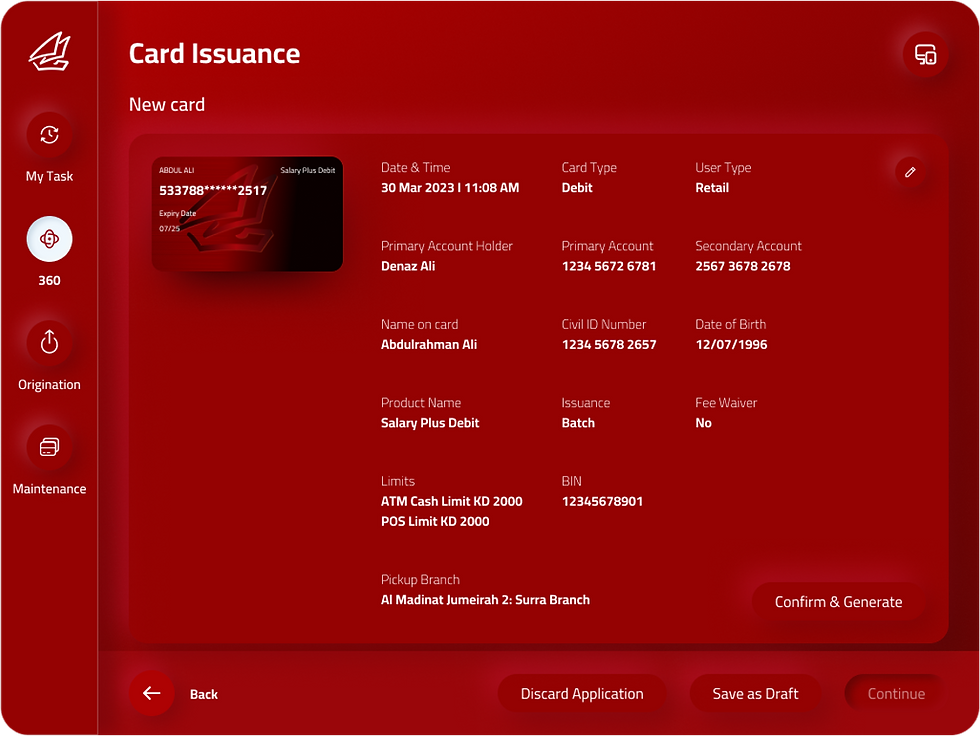

DESIGN AND TASK FLOWS FOR BANK TELLER SCREENS

The visual design of the screens prominently follow the brand language and were designed to be sufficiently intuitive for ease of use and seamless functioning of all tasks.

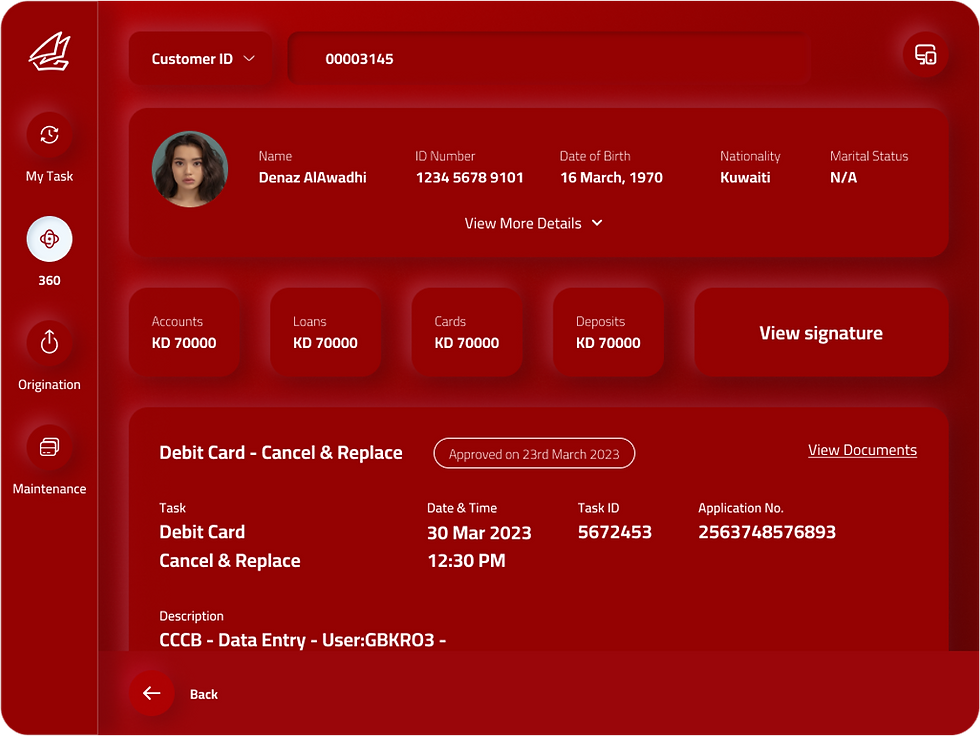

TELLER SCREENS (LOGIN + CUSTOMER 360)

TELLER SCREENS (MAKER- CREATING A NEW TASK)

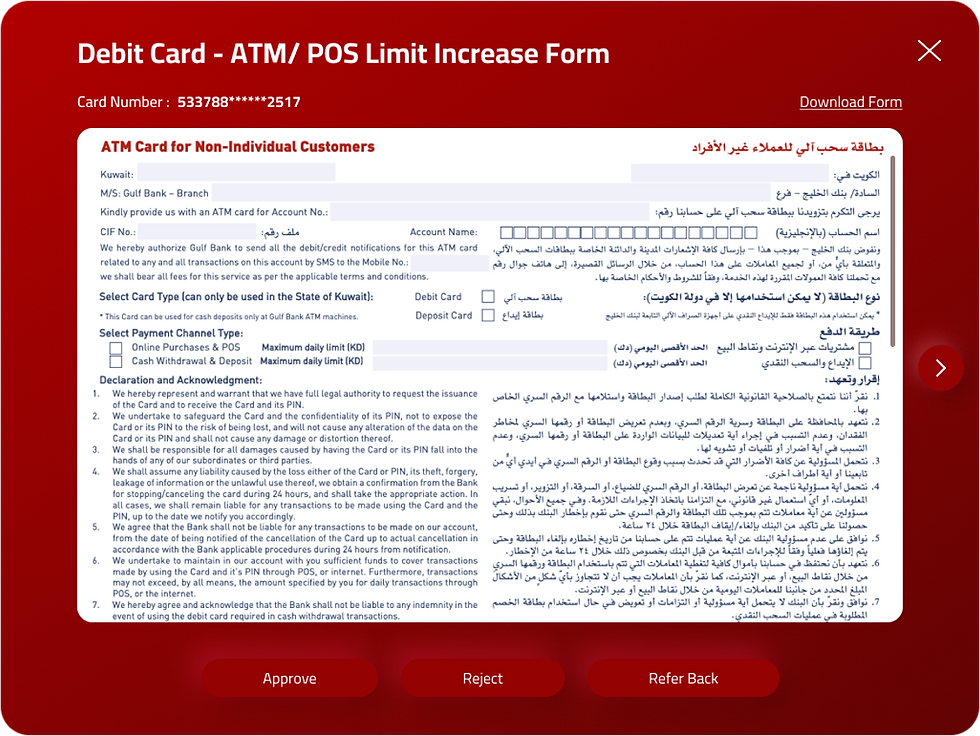

TELLER SCREENS (CHECKER- ACTION ON A NEW TASK)

CREATING A COMPREHENSIVE DESIGN SYSTEM & STYLE GUIDE

We provided a comprehensive style guide for the kiosk and the teller screens. Additionally, we developed component sets for all interactive elements and designs, ensuring straightforward application and consistency across the platform.

Fig 8: Four sections of an entire design system created for the development of the screens

KEY LEARNINGS

-

Flow Decoding and Adaptation: Gained expertise in interpreting client-provided flows and adapting designs to balance client needs with optimal user experience.

-

Effective People Management: Developed skills in managing team dynamics and aligning diverse perspectives to drive project success.

-

Principled Design Approach: Emphasised a design-first mindset, maintaining objectivity while clearly communicating recommendations and limitations.

GULF BANK- KUWAIT: BRANCH AUTOMATION

ROLE & DURATION

UI Designer

Team of 2

Stakeholder Visioning, Experience Design, UI Design

Jan - Mar 2023

bottom of page